- Details

- Written by: Douglas Berry

- Category: Pythagorean

- Hits: 322585

Transforming Business Models With AI

Industry disruption arrives with both a cost and risk. CTOs must balance the cost and risk to determine where in the innovation S-Curve they want to adapt to the disruptive technology. Enter early and the potential rewards could be massive. However, entering too early when the disruptive technology is not mature enough could result in a significant loss of core assets.

New business models, simplified business processes with smart predictive and optimizing analytics are key properties of a business transformation journey. Knowledge of today's capabilities helps create an end state target for your business landscape where you can plan, budget and manage projects to competitive change drivers. You need to adopt a basic strategy for analytics including a dependencies roadmap. Analysis of customer purchase data, competitor data, market data, social data and SKU data mined from corporate ERP transaction systems are required for modernized Financial Planning and Analysis, Commercial Finance and Supply Chain Finance Analytics used for growing or scaling the business ecosystem.

TekMetrix leadership, presence and decision making has the most impact when there are transformational changes in the business environment. When change occurs we lead. Our leadership capabilities that make a difference are:

- Senior business and technical architects

- Move forward with focus

- Understand the power of timing

- Create a flywheel - use our efforts to initiate change and maintain it

- Empower people to develop high performing teams

Staffing our teams is purposeful, we maintain these attributes for our professional services teams:

- Learning - cognitively and affectively

- Well designed program and project plans - clear goals and tasks assignments

- Share experiences - within and outside the team

- Dynamic - with the changing market or technology

- Diverse and inclusive - optimize team performance with diverse experiences

- Right size - not over or under staffed

- Managed - well formed and tooled with experienced skills and technology

TekMetrix Ambidextrous Innovations Matrix

Our methods and solutions enable the design and implementation of new end state corporate performance capabilities. Rapid accelerators derived from client experience and internal research are used to implement a multitude of modern business competencies based on simplified analytical data models, machine learning and clustering, AI, simulation and optimizing algorithms on your financial, logistics and human capital processes. All in memory and in real time with data lake extensions.

We separate the science of creating your strategy and technical road map from the mechanics required to implement. Our recommendations are supported by a detailed financial business case based on Capital, Net Cash Flow and Net Present Value with quantified Capital and Expense investment value against business process cost drivers. A full CFO view of Total Cost of Ownership (TCO).

We understand the process of technology disruption, and therefore we assist our clients recognize opportunities. Disruption can occur against the incumbents business model or technology in use or both. During the era of disruption many different business models and technologies are used by the industry to satisfy customer needs. Over time a dominant design for an ecosystem of business models and technologies is established. These are satisfying customer needs. After the dominant design is established an era of incremental innovation is established. Innovation will reach the limits of the business model and technology and the industry will mature, over time new business models and technologies emerge and the process repeats itself.

Industry change may happen within the core assets of the organization, within the business model itself or both the assets and business model.

A Model of Industry Distruption and Establishing a Dominant Design

| Disruptive Change for an Established and Mature Organization | |

| Business Model - Choices regarding | Core Assets - Resources and Capabilities |

| - Cost of Production and Profit | - SAP, Compute Platforms & Software |

| - Monetization | - Molecular, Product Research and Marketing |

| - Value Proposition | - Supply Chain Execution |

| - Customers | - Enterpise AI, ML |

| Change Management |

|

| Business Model Change | Change in Assets |

| - Harder than Asset Changes | - Challenging |

| - Complex | - Function of Investment |

| - Change Organization Incentives / Processes | - Can be Performed Internally through R&D |

| - Significant Uncertainty of Long Term Growth | - Strategic Acquisitions |

Innovate and Manage Disruptive Changes

- Strategic Mindset: Responding to and Creating Change

- Encourging an Ambidextrous Organization for Innovation

- Blockchain and Cryptocurrencies

- Ecosystem, compute platform and focal offers strategy

- Establishing Technology Policies

- Technology Entry Strategies

- Creating and Commercializing Ideas

- Creating New Digitized Business Models

- Aligning IT Strategy with Corporate and SBU Strategy

- Trends in Global Technology

- Industry Cloud Enterprise Architecture and Migrations - S4 Cloud as Digital Core

- Frameworks and building blocks

- Business Diagnostics, Machine Learning and Clustering, Deep Learning, Leonardo Anaconda, Python, R

- IOT and Big Data Use Cases and Solutions Architectures

- Green, Environmental, Social and Governance for the New Business Era

- Competitive Implications of the AI Stack

- SAP and non-SAP AnalticA

- Leading Innovative Processes

- Balancing Internal and External Modes of Innovation

- Technology Acquisitions

- Demand Planning, Trade and Supply Chain Finance

- FP&A and Commercial Finance

- Simplified Data Models for Reporting, Analytics, Predictive and Optimization of Cost and Value Drivers

- Planning, Forecasting, Variance Simulations and Analysis

- SAP S4/HANA BW/4HANA FP&A PaPM, TPM ATMA SAC Analytics

- SAP Enterprise Architecture

TekMetrix LLC is a technology solutions company that provides

management, scientific and technical consulting services.

The company is registered in Houston, Texas.

Logging In

Create a user name and password to Log in. Once logged-in you will be able to download our tools and methodologies and share your experiences and feedback.

- Details

- Written by: Douglas Berry

- Category: Pythagorean

- Hits: 677

Customer Life Time Value Forecast Using BYDT Models

TekMetrix AnalyticAI uses trusted Buy Till You Die (BTYD) models. These models are a class of statistical models designed to capture the behavioral characteristics of non-contractual customers, where the corporate entity cannot directly observe when a customer stops being a customer. The goal of BTYD models is to forecast customer lifetime value by jointly modeling two processes:

- Repeat purchase process - This explains how frequently customers make purchases while they are still "alive" (active).

- Dropout Process: This models how likely a customer is to churn (stop being a customer) in any given time period.

Common versions of BTYD models include the Pareto/NBD model and the Beta-Geometric/NBD model. These models help businesses understand customer purchasing behavior and predict future purchasing patterns. Below is a TekMetrix AnalyticAI case history for developling an Industry CPG BYDT model and subsequent customer lifetime value.

- Details

- Written by: Douglas Berry

- Category: Pythagorean

- Hits: 1391

Quantifying Decisions Under Uncertainty

There are modeling approaches for predicting outcomes under low uncertainty settings and a different modeling approach for predicting outcomes under high uncertainty. Linear programming, under low uncertainty settings, allows us to calculate an objective function and determine if the solution is feasible based on resource constraints. For high uncertainty settings we need to calculate the distribution for the key performance indicators and compare the distributions of outcomes.

Steps to calculate the distribution of the sales performance KPI for a product under high levels of uncertainty:

- Define the KPI: Total number of units sold.

- Collect data: Collect data on the total number of units sold over a month.

- Calculate the average: Calculate the average number of units sold per day.

- Calculate the standard deviation: Calculate the standard deviation of the number of units sold per day.

- Plot the distribution: Plot the distribution of the number of units sold per day using a histogram or a box plot.

Roadmap for making decisions in high uncertainty environments:

- Confirm risk and reward measures

- Use simulation for each competing decision to estimate reward and risk measures via a distribution:

- Normal distribution

- Bernoulli

- Binomial

- Poisson

- Patterned

- Discrete

- Optimize reward (Demand Volume) as an objective function with risk measures as constraints

- Results of the simulations can be fed into an optimizer forming an effective management decisioning tool set

Digital Twins

A digital twin is a virtual representation of a physical object or system that is updated in real-time using data from sensors and other sources. It uses simulation, machine learning, and reasoning to help decision making. Digital twins are used to simulate the behavior of physical objects, systems, or processes to better understand how they work in real life. They can be used to study performance issues, generate possible improvements, and create valuable insights, which can then be applied back to the original physical object. There are various types of digital twins depending on the level of product magnification, such as component twins, parts twins, asset twins, and system or unit twins. Digital twins are used in various industries and applications, such as manufacturing, healthcare, and transportation.

Simulation of Manufacturing Processes

SAP HANA is an in-memory database and application development platform that provides real-time data processing and analytics capabilities. R is a popular open-source programming language for statistical computing and graphics. SAP HANA provides integration with R through the RLANG procedure, which allows embedding R code in SAP HANA SQL code and execute it using the external R environment. We use R to perform statistical analysis, data mining, and machine learning on data stored in SAP HANA.

Additionally, R is software tool used to simulate manufacturing processes, that is to create a Digital Twin. We use a simulation package in R for discrete-event simulation that allows us to create statistical variables required for simulation, define process trajectory, define and assign resources, define arrivals, run simulation in R, store results in data frames, plot charts, and interpret the results.

To simulate a manufacturing process, working with your organization, TekMetrix will create process maps, gather data, build and test the simulation mathematical models, and work with your organization to analyze and interpret the results.

Delivery Methods

- Build a virtual representation of the supply chain using R or equivalent

- Select the simulation technique:

- Enterprise modeling and simulation - create a Digital Twin of the manufacturing system to optimize various aspects of production planning, inventory management and resource allocation

- Data-driven simulation - using data and analytics with machine learning create a predictive model of the manufacturing system to optimize production scheduling, quality control and maintenance

- Process simulation - simulate individual business processes within the manufacturing system to identify bottlenecks, optimize resource alloction and improve efficiency

- Agent-based simulation - simulate the behavior of individual agents within the manufacturing system such as unit operations, machines, workers and customers to optimize production scheduling, resource allocation and customer service

- Discrete event simulation - simulate the flow of discrete events within the manufacturing system such as the arrival of raw materials, processing of parts and shipment of finished goods. Businesses can optimize various aspects of production scheduling, inventory management and quality control

- Monte Carlo - model project timelines seeking to optimize resources and used for financial forecasting

- Dynamic simulations - time based simulation models coded as solutions to partial differential equations.

- Engage TekMetrix Supply Chain Diagnostics

- Optimize customer value by leveraging innovation, transparency, efficiency and resillence in the supply chain

- Find new sources of innovation and value creation using the simulations

- Create sustainable value for your organization

- Details

- Written by: Douglas Berry

- Category: Pythagorean

- Hits: 781

Optimizing Decisions

Prescriptive analytics seeks to analyze, for example, past consumer behavior to predict future behavior. Prescriptions are recommendations. Therefore, how do we define a prescriptive problem, how to set goals and objectives, how can the company optimize the goals and objectives, what actions can a company take to affect the outcome of their goals and how do companies respond to other companies actions?

The market structure needs to be a part of the model. If the company takes an action, for example, price change of the product, then how do other companies in the market respond? These are the questions that prescriptive analytics will answer. Willingness to pay (WTP) measures the maximum amount a customer is willing to pay for an incremental purchase of a product or service. WTP is calculated as:

WTP = ((New Price + Old Price) * Price Increment)/2 = > Trapezoidal Rule

TekMetrix WTP solutions improve brand performance by:

- Predicting market demand

- Setting channel prices

- Making formulation decisions

- Determining promotional spend strategy

- Communications strategy

- Creating dashboards and reports

- Determine the relationship between variables

- Understand why and how issues occur

- Create an interative process between analytic and decision making

- Make decisions

- Units to produce

- Channel price

- Formulation

- Product features and positioning

- Trade channel spend

- Media spend

- Target market segment for decisions

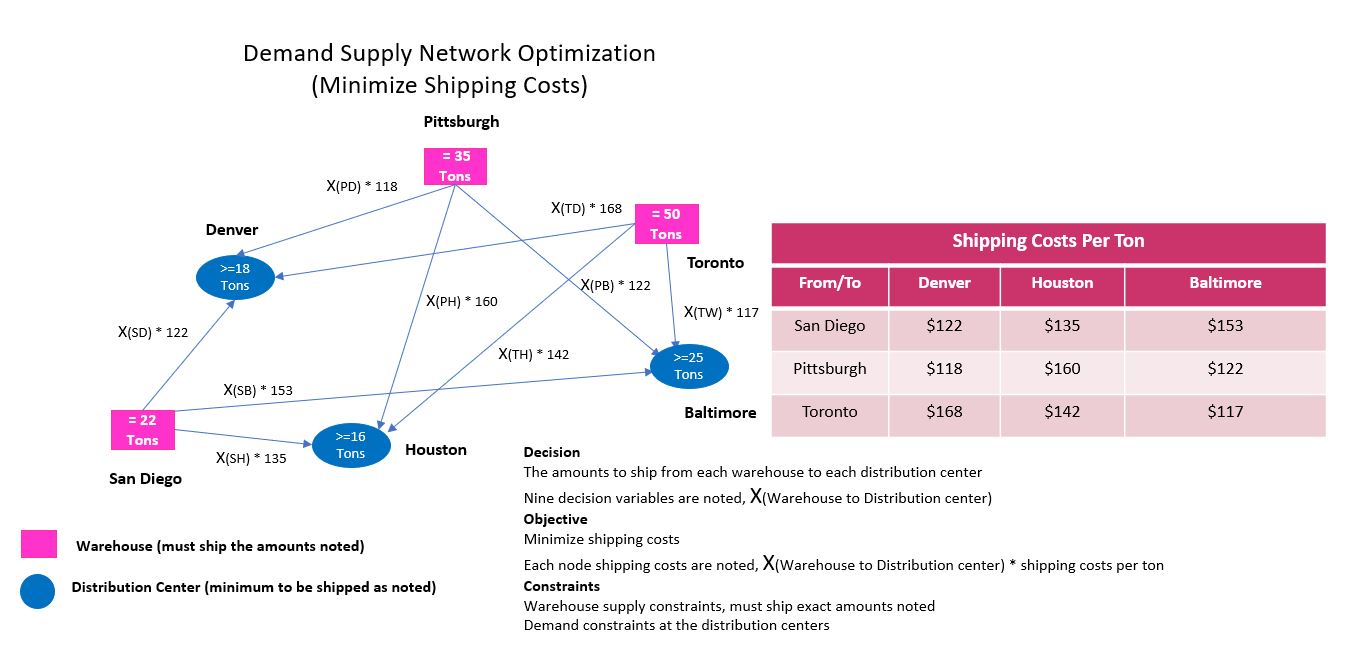

Linear and Interger Programming In The Absence of Uncertainity

Powerful optimization technology is available to find the best solutions to complex problems faced by many organizations. Minimizing or maximizing an objective function which is dependent on variables such as costs, quantities, sales, price, profit while constrained by capacity, resources, dollars has been a well defined and utilized approach since the middle 1940s when logistics optimization mathematics were developed, known as linear and non-linear programming (LP) and integer (IP) programming. LP and IP models combined with AI algorithms will learn your business data and continuously maximize or minimize the objective function. We generally apply these optimization models to specific business challenges with low uncertainity to determine the most favorable outsome to the business problem.

- Objective function - defines the maximizing or minimizing function that we want to achieve

- Decision variables - parameters that can be controlled or adjusted to influence the outcome of the objective function

- Production quantities

- Resource allocation

- Cost of goods

- Revenue

- Scheduling

- Constraints - mathmatical expressions that limit the values or the relationships between decision variables

- Resource availability

- Capacity limits

- ERG requirements

Optimization Model Types

- Deterministic Optimization

- Solves problems with known parameters and with minimum uncertainty in the decision variables

Examples include linear programming (LP) and integer programming (IP)

- Solves problems with known parameters and with minimum uncertainty in the decision variables

- Stochastic Optimization:

- Operates with uncertainty or randomness in parameters

- Objective function and constraints involve probabilistic or random variables

- Nonlinear Optimization:

- Handles problems with nonlinear functions in the objective or constraints

- Commonly used in finance, engineering, and logistics

- Heuristics:

- Approximate problem-solving techniques when finding an exact optimal solution is computationally infeasible

- Applications:

- Operations Research: Optimize supply chains, production processes, and resource allocation, product pricing and revenue growth

- Finance: Portfolio optimization for better investment strategies, trade promotion management costs

- Logistics: Route optimization, inventory management, and scheduling, supply chain finance, matching demand and supply across a supply chain network

- Engineering: Design optimization, process improvement, and quality control

- Benefits:

- Cost Reduction: Optimized resource allocation minimizes costs

- Efficiency Improvement: Streamlined processes lead to better productivity

- Strategic Planning: Evaluate scenarios and alternatives for long-term decisions

Optimizing modeling with AI enables businesses to make data driven decisions, adopt new technologies, innovate and adopt to changing environments. With todays computational innovations and SAP transaction and master data modeled in HANA, SAC, PaPM significant upside potential exists for businesses to capture. An optimization model can have only one objective but can have many decision variable and constraints. For example if a company wants to optimize multipe key performance indicators such as profit, costs and resource allocation then we can choose one of the key performance indicators, like profit and treat the others as constraints.

Linear models are easier to optimize than non-linear models. Linear models involve constant parameters, multiplication products of decision variables and constant parameters and addition and subtraction. Non-linear models involve products of decision variables, ratios of decision variables, power or roots of decision variables, anything beyond a linear function.

Simplified solver model optimizing demand supply objective with decision variables and constraints

- Details

- Written by: Douglas Berry

- Category: Pythagorean

- Hits: 850

Predictive analytics involves various algorithms and techniques to forecast future outcomes based on historical data. They are the backbone of operations research professionals, and now with AI are available to larger parts of an organization. These algorithms have been available for 50+ years yet not often are not deployed by a corporation. If used, most often they deployed in Excel, which is limited in the amount of data that can be ingested.

These algorithms need be deployed on large data sets, Hana, S4/HANA, BW, and Hadoop with BTP integration from multiple sources to be fully effective. With modern compute power and infrastructure, and with the integration of these algorithms to an AI tool, they can be effectively deployed.TekMetrix analyticA architectue uses AI LLM models optimized for software development to deploy these algorithms for highly value add process scenarios. Here are some of the key algorithms and techniques used.

What is a Sales Forecast Example?

Linear Regression

- Description: A statistical method that models the relationship between a dependent variable and one or more independent variables by fitting a linear equation to observed data.

- Use Case: Predicting sales volume, price, labor costs, material costs, commodity prices, stock prices, or any continuous outcome.

Logistic Regression

- Description: Used for binary classification problems, it predicts the probability of a binary outcome (e.g., yes/no, true/false).

- Use Case: Fraud detection, customer churn prediction, product quality

Decision Trees

- Description: A tree-like model of decisions and their possible consequences, including chance event outcomes, resource costs, and utility.

- Use Case: Classification and regression tasks, such as determining whether a customer will buy a product, new product introduction.

Random Forest

- Description: An ensemble learning method that constructs multiple decision trees during training and outputs the mode of the classes (classification) or mean prediction (regression) of the individual trees.

- Use Case: Improving accuracy and robustness over single decision trees.

Gradient Boosting Machines (GBM)

- Description: An ensemble technique that builds models sequentially, each new model correcting errors made by the previous ones.

- Use Case: High-performance tasks like ranking, classification, and regression.

Support Vector Machines (SVM)

- Description: A supervised learning model that analyzes data for classification and regression analysis by finding the hyperplane that best divides a dataset into classes.

- Use Case: Image recognition, text categorization.

Neural Networks

- Description: Computing systems inspired by the biological neural networks that constitute animal brains, capable of pattern recognition and learning from data.

- Use Case: Complex tasks like image and speech recognition, natural language processing.

K-Nearest Neighbors (KNN)

- Description: A non-parametric method used for classification and regression, where the input consists of the k closest training examples in the feature space.

- Use Case: Recommender systems, anomaly detection.

Time Series Analysis

- Description: Techniques that analyze time-ordered data points to extract meaningful statistics and other characteristics.

- Use Case: Forecasting stock prices, weather prediction.

- ARIMA (AutoRegressive Integrated Moving Average): Combines autoregression, differencing, and moving average models.

- Exponential Smoothing: Applies weighted averages of past observations to forecast future values.

Clustering Algorithms

- Description: Grouping a set of objects in such a way that objects in the same group (cluster) are more similar to each other than to those in other groups.

- Use Case: Market segmentation, image compression.

- K-Means Clustering: Partitions data into k clusters, each represented by the mean of the points in the cluster.

- DBSCAN (Density-Based Spatial Clustering of Applications with Noise): Finds core samples of high density and expands clusters from them

Data Modeling

Data in the CPG industry comes from a variety of sources including SAP sales and supply chain transaction data, marketing sources and customer behavior. The CPG industry is challenged with creating analytics on this data and using the data for predictive and optimizing purposes. The complexity lies in creating a data model. Without a proper knowledge of HANA columnar databases, open source databases and POS integration technology forecasting and analyzing SKU data is a challenge. Predictions that need be made are which customer is going to buy what product next, how many purchases are they going to make and what is the customer churn? What is my customer life time value, how often to they buy and when was the last time they bought a product. Other types of predictions include trade and promotions, pricing, conversion costs and marketing (sg&a) costs. TekMetrix tools are readily available for making these predictions and more. SKU level predictions can be made and structured into a P&L (SKU) level, cash flow and balance sheet. Analysis of the P&L and other financial documents can be done by SKU, customer, geography, brand and other attributes, including aggregations. We can forecast into the future your customer lifetime value (CLV).

The question becomes, how to design and develop an underlying data model supporting a variety of analytics and predictive metrics including embedding AI and ML capabilities into the underlying data model? TekMetrix data AI ML models and experience will accelerate your project timelines and add significant value to your business.

Defining the Right Questions

If you want to run your business most effectively, we need to make predictions about the future. Predictive analyical forecasting takes historical data and creates a one or multi period forecast. TekMetrix data analysis helps examine past performance and also helps to predict future performance, for example predicting questions like:

- Customer purchases

- Customer life time value

- Warehouse inventory

- Cost of goods sold

- Revenue

- Customer returns

- Pricing

- Trade promotion costs

- Contribution margin impact of incremental sales due to trade promotions

We want to make "when will" predictions for a fixed period and multiple periods in the future.

- Inherently granular

- Customer behavior

- Foward looking

- Multi-platform

- Broadly applicable

- Multidisciplinary

Predictive Statistics

Predictive statistics uses statistics for prediction and forecasting generally one period ahead of the current period. The mean of the prediction is the sample mean which is an unbiased estimation of the mean of true demand distribution. Standard deviation for prediction needs to be adjusted if there is insufficient data. If the data is normally distributed than the data can be adjusted for predictive purposes.

If there is a trend in the data, than moving averages, mean and standard deviation computations used for predictive purposes will lag the trend. Therefore, linear regression or exponential smoothing are additional forecast options.

Regression Example - Predict 1 Period Ahead of the Current Period

The regression equation and its variants are used in Artificial Intelligence (AI) and Machine Learning (ML) modeling. These equations help us understand the relationship between independent variables (features) and a dependent variable (target) by fitting a mathematical function to the data. Various types of regression models, such as linear regression, polynomial regression, and logistic regression, are commonly employed for prediction, classification, and modeling tasks. These models can be developed in SAP HANA, SAC, PaPM. Additional tools could be MatLab, R, Python, or for smaller models in Excel.

- Revenue growth management, as an example can be optimized using regression analysis. Optimal pricing is the price which optimizes overall profit. Models are built to:

- Quantify sales demand at different prices

- Find the optimal price

- Optimization performed with the general regression formula: Y(n) = a + b1X1(n) + b2X2(n) + .... bjXj(n) + E(n) , X values are independent of Y and E(n) it error

- Multiple independent variables can be modeled, for example Sales = a + b1(Price) + b2(Advertising) + E

- The regression equation and variants of the regression equation are used for AI and ML modeling

Key Performance Indicators Use In Forecasting Beyond Period 2:

- Direct marketing example using regression analysis can be used to predict future, multiperiod, customer behavior:

- Use key performance indicators of past customer behavior to predict future behavior

- Regression models are also useful for this type of modeling and forecasting

- Regression model predictions using RFM models are used to forecast customer behavior (recency, frequency, monetary value)

- Recency - what were the recent customer purchases (more important than frequency)?

- Frequency - how many purchases did the customer make (more important than monetary value)?

- Monetary value - what is the value of each of the purchases?

- Probability models can be used to forecast longer term horizons

- Buy till you die models (BTYD) are a powerful probabilistic model used to make long range projections, to answer when type questions, when will a customer churn?

- Customer lifetime value modeling using Pareto/NBD and BG/BB models

- Limitations of regression models

- Forecasting more future periods than period 1 beyond the current period, regression models are limited because they need input data

- Making predictions for period 3 than period 2 data can be used as the independent variable

- Regression models are limited based on the data that is available to forecast multiple periods into the future

Sales Forecast Example

AI integration with Corporate Data and Linear Regression:

- Data Collection: Gather your historical sales data, including variables that might influence sales, such as marketing spend, seasonality, and economic indicators.

- Data Preprocessing: Clean and prepare the data for analysis. This involves handling missing values, encoding categorical variables, and scaling numerical features, unnecessary data from the data model, billions of records are sufficient.

- Feature Selection: Identify the independent variables (predictors) that are most relevant to predicting the sales. This might be total advertising spend, average product price, or number of holiday promotions.

- Model Training: Use the cleaned and preprocessed data to train the linear regression model. Copilot can help automate this by fitting the linear equation y=b0+b1x1+b2x2+...+bnxn, where y is the dependent variable (sales), and x1,x2,...,xn are the independent variables.

- Model Evaluation: Assess the performance of the model using metrics like R-squared and Mean Squared Error (MSE) to ensure it accurately predicts sales based on the input features.

- Prediction: Use the trained model to make predictions on new data. This is where AI can shine, taking the input variables and outputting a sales forecast.

By managing these steps, TekMetrix AI integration can streamline the entire process of creating and continuously updating a sales forecast. Let’s say we have billions of records in S4-BW4/HANA. We input the data along with variables like marketing spend, holiday seasons, supply chain cycle times, availabilities and econometrics. TekMetrix AI preprocesses the data, selects the best predictors, trains the forecast model, evaluates model performance and then uses it to forecast next month’s sales.