TekMetrix Diagnostic and Optimization Software

Innovations and Research

Hypothesis

Corporate innovation and analytic projects can often be a challenge for project teams due to various pain points, including lack of data-driven insights, slow and inefficient decision-making processes, and difficulties in implementing recommendations. Additionally, traditional consulting methods can be expensive and time-consuming, leading to a lack of scalability and limited ROI. These issues can result in missed opportunities for growth and improvement, causing frustration and hindrance to a company's success. By addressing these pain points with diagnostic driven analytical software consulting firms can improve their client’s business operations and help them stay ahead in today's fast-paced and competitive market.

TekMetrix Solutions

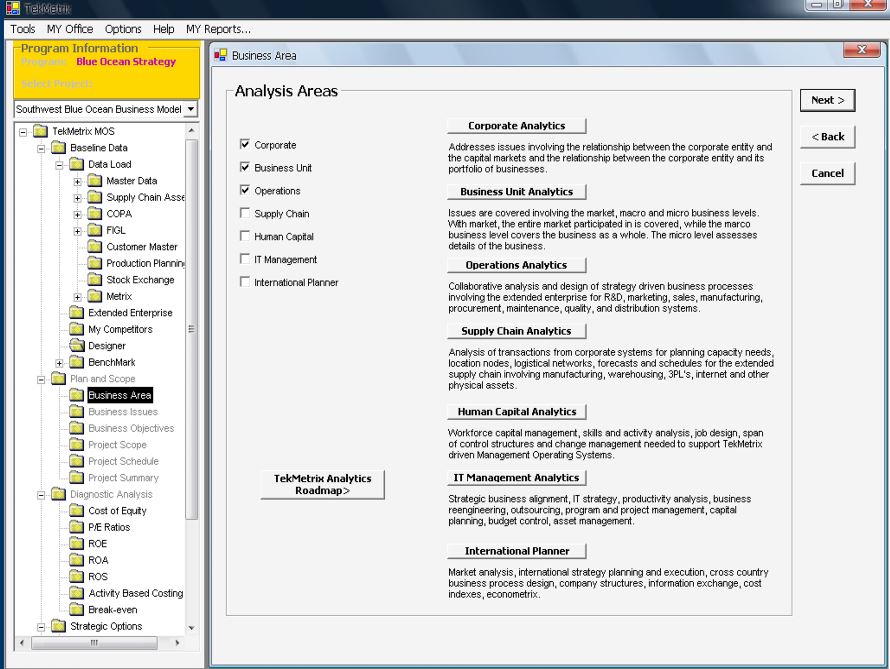

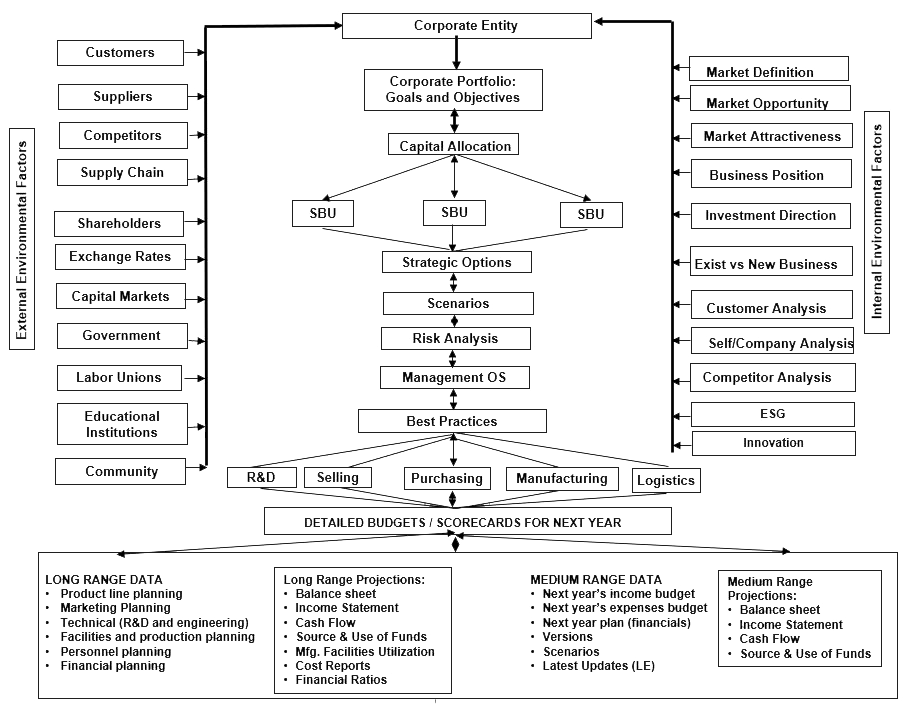

TekMetrix business consulting diagnostic software leverages advanced AI technologies such as artificial intelligence, machine learning, and data analytics to provide organizations with a comprehensive analysis of their operations, challenges, and opportunities. TekMetrix software consists of 250 integrated business diagnostic algorithms layered on pre-configured TekMetrix data models. The data model master and transaction data used for analysis and optimization derived from SAP S4 and not SAP ERP systems. Our software optimizes business processes deployed in corporate ERP systems.

TekMetrix software uses a combination of automated data collection, analysis, and inference engines to deliver actionable recommendations and insights that are tailored to each individual line of business across multiple industries. The software eliminates the need for manual data modeling, data analysis and interpretation, freeing up valuable time and resources that can be redirected towards implementing solutions and driving growth. Real-time data integrated with corporate AnyERP, S4, AnyDB and SAP HANA provides executive management, comptroller, financial and supply chain analysts with a shared analytical ecosystem. TekMetrix innovations value is comprosed of 4 variables. Value created (VC)= F(Concept, Execution, External Factors). Value Created is used as metric to guide the success of deploying TekMetrix Diagnostic and Optimization software.

Algorithms Integrated WithTekMetrix Software

-

Regression Analysis: Regression models help predict numerical outcomes based on input features. For financial data, linear regression, polynomial regression, and other variants are often employed to model relationships between variables.

-

Time Series Analysis: Time series models capture patterns and trends in data over time. Techniques like ARIMA (AutoRegressive Integrated Moving Average) and exponential smoothing are useful for forecasting financial metrics.

-

Machine Learning Algorithms:

- Random Forests: An ensemble method that combines multiple decision trees to make predictions. It’s useful for feature importance analysis and risk assessment.

- Gradient Boosting: Another ensemble technique that sequentially builds decision trees to improve prediction accuracy.

- Neural Networks: Deep learning models, such as feedforward neural networks and recurrent neural networks (RNNs), can learn complex patterns from financial data.

-

Clustering Algorithms:

- K-Means: Used to group similar data points together. In finance, it can help identify customer segments or detect anomalies.

- Hierarchical Clustering: Creates a tree-like structure of clusters, useful for portfolio diversification.

-

Optimization Techniques:

- Linear Programming: Solves optimization problems with linear constraints. It’s used for portfolio optimization, resource allocation, and supply chain management.

- Integer Programming: Extends linear programming to handle integer variables, suitable for discrete decision-making.

-

Graph Theory Algorithms:

- Network Analysis: Graph algorithms like centrality measures help analyze financial networks (e.g., interbank lending networks).

-

Statistical Tests:

- Hypothesis Testing: Determines whether observed differences are statistically significant. Common tests include t-tests, ANOVA, and chi-squared tests.

- Correlation Analysis: Measures the strength and direction of relationships between variables.